Tutorials

Stock Price Analysis

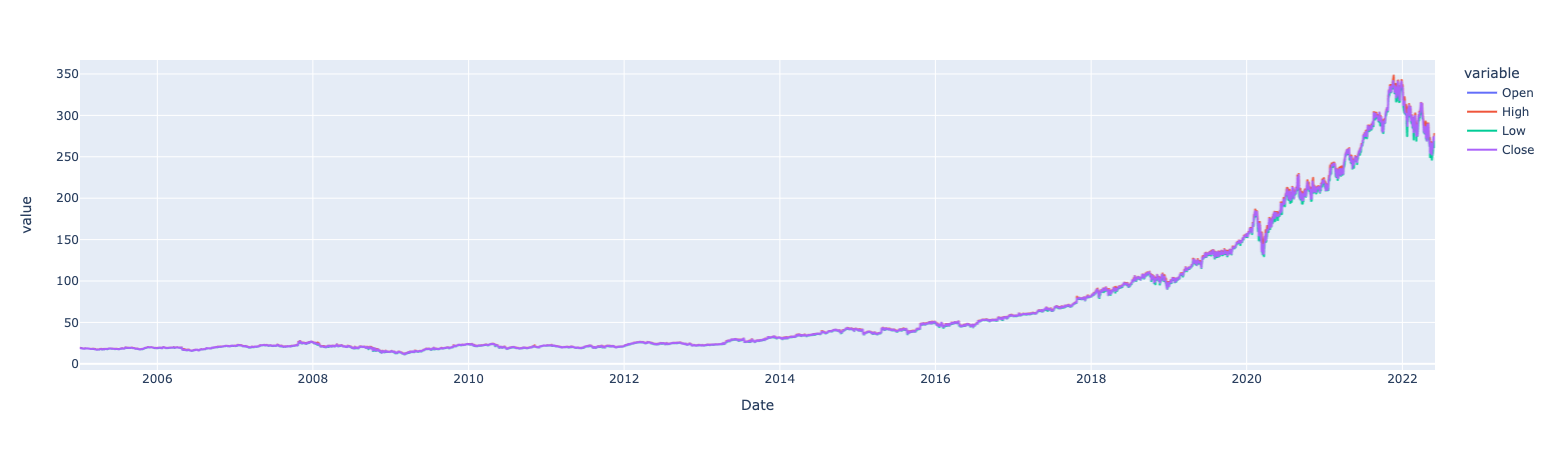

All the processing starts with the data to be analyzed. Here we are getting the Microsoft stock price from 2005 on.

# Import libraries

import yfinance as yf

import wavy

import pandas as pd

# Read in the data

msft = yf.Ticker("MSFT")

# Get historical market data from 2005 on

hist = msft.history(period="max", start="2005-01-01")

With the data we can filter the interest columns and .

# Select the interest columns

hist = hist[['Open', 'High', 'Low', 'Close']]

# Plot the data

hist.plot()

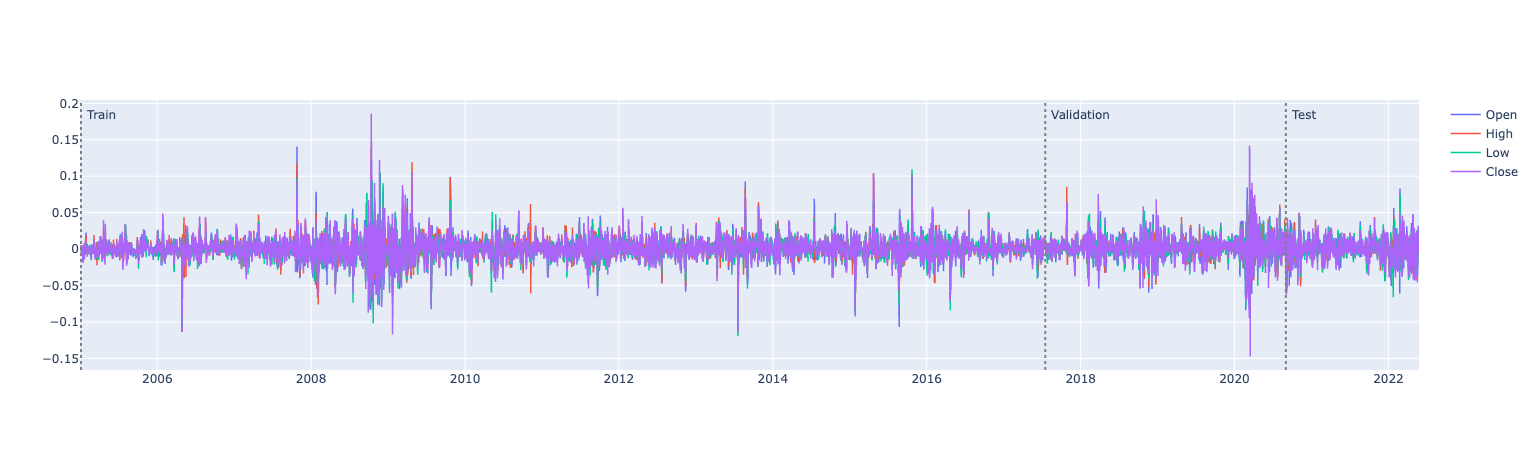

Calculate the percent change and drop rows with NaN.

# Calculate percent change

hist = hist.pct_change()

# Drop rows with NaN

hist.dropna(inplace=True)

We will create a model to predict if the stock in the next day will close higher or lower based on the information of the last 5 days. For this, we will create the panel using the following configuration.

# Create panels

x, y = wavy.create_panels(hist, lookback=5, gap=0, horizon=1)

# y will be the Close price of the next day

y = y[['Close']]

# Convert y to boolean

y = y['Close'] > 0

# Plot x

x.plot()

Now we can create the model.

# Create model

densemodel = wavy.DenseModel(x, y, model_type="classification")

With the model we can fit, and see the score for the validation set.

# Fit model

densemodel.fit()

# Score

densemodel.score(on='val')

If we want, we can also predict on another dataset.

# Predict

predicted = densemodel.predict(data=x.val)